#1 - We recommend you review this brief loan guide to understand which is the best route for you to consider - pay your loans off faster or pay less each month? It has a 3-minute video as well.

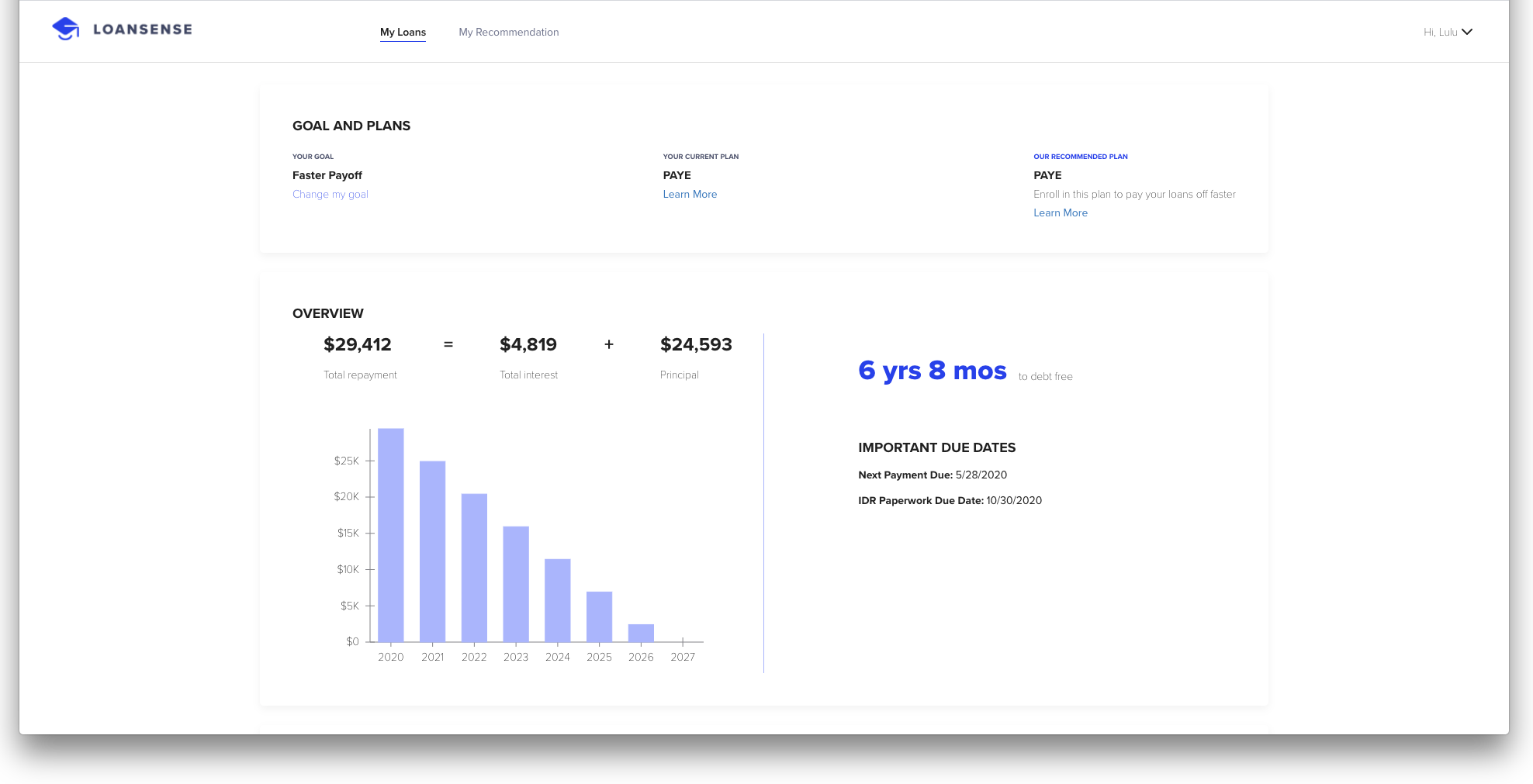

GOALS AND PLANS

This summarizes your current plan and the recommended plan. You can learn more about these plans here.

It also has a goal - you can amend it. There is "Faster Payoff" Or "Pay less each month". We also have aligning tools based on your goals. "My Recommendation contains the "Pay less" goal and the "Monthly Payment Tool" is for the "Faster Pay off" goal.

Again, review the loan guide to help you break down which is the best route for you to consider.

OVERVIEW

This section breaks down your total repayment in an equation with your loan interest and principal. It also has a projection of your payoff timeline. It helps you track the time until you are debt-free along with all the vital dates: payment dates and your annual paperwork due date. The IDR Paperwork due date is really important! You do NOT want to file late because the interest will accrue onto the principal and cause your loan payment to increase if you file late.

LoanSense will send you a reminder via email. However, we also recommend you put a reminder in your personal calendar two months before the due date. We recommend submitting the paperwork at a minimum of 14 days prior to the IDR paperwork due date. You should really submit 21 days or a month early, so you have time to check it's been submitted on time.

LoanSense can file for you if you are in an Income-Driven Repayment Plan, Public Service Loan Forgiveness, or consolidating your loans. To file go to our application. Click on the "My Recommendations" tab and you'll see the tab to click "File my Loans".

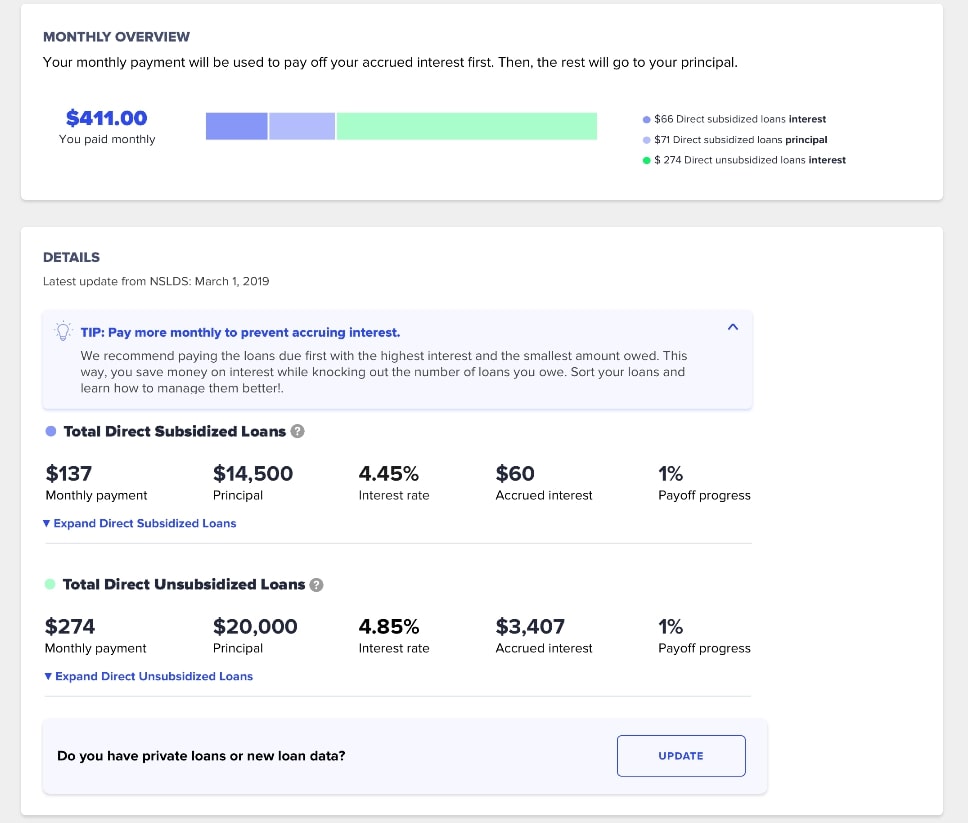

MONTHLY OVERVIEW

This section helps you understand which part of your payment is going to interest versus principal payments. It details the breakdown visually with different colors. The menu highlights the dollar value of each interest and principal of your loans.

DETAILS

The tips include tips that are relevant to your plan. For example, if you are a public servant, we would NOT recommend paying more than your monthly payments or paying ahead of schedule. We would recommend you only pay what is necessary to maximize the amount of forgiveness. For others who want to pay their loans quicker and are NOT on an income-driven plan, we recommend paying the loans with the highest interest first. There are even letters to submit to your servicer, so they automatically do this.

Loans

We breakdown the monthly payments, principal, interest rate, and accrued interest per loan. You can expand the menu to see all your loans under this type of loan. This data is pulled from the loan servicer text file you uploaded or you manually entered while onboarding into the application.

Breakdown of Loan types here.

UPDATE

Lastly - We help you update your loan dashboard by uploading your student loan dashboard. This will take you to a screen with detailed in-app instructions on how to upload your loans.

If you have any questions - please email us at loanhelp@myloansense.com

Get Started Now>>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.