It's vital before you proceed with student loan decisions to understand if you will pay your loans faster or pay less each month and get loan forgiveness.

Step 1: Know your student loan pay off approach

Here is a video and written guide to setting your loan payoff approach. After you set your payoff approach of paying quickly or paying less each month, then you will know if this is the best tool for you to consider.

Step 2: Follow the advice of the right screen based on your loan payoff approach

If you plan to pay your loans quickly, then the "Monthly Payment tool" is perfect. If you want to pay less, then follow our "My Recommendation" tab.

Why is the monthly payment tool less useful if you want loan forgiveness or Public Service Loan Forgiveness? If you plan to receive student loan forgiveness, then paying more towards your student loans will only mean less forgiveness. This means you are literally just giving the federal government more money than is required and in this case, there is NO point to loan forgiveness.

Step 3: Learn about the Monthly Payment tool outputs

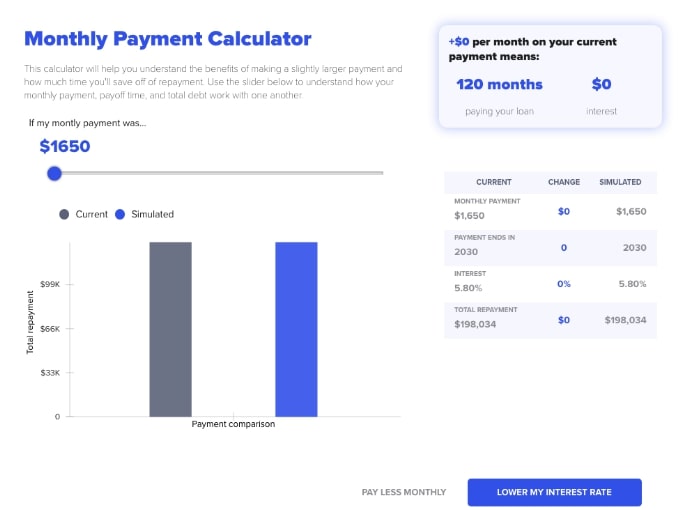

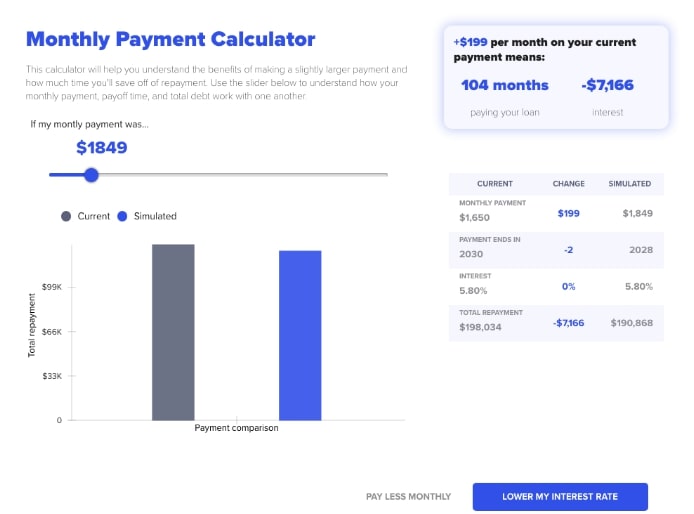

The toggle bar will start with your standard loan repayment amount. If you slide the bar towards the right-hand side, the numbers in the box and grid to the right of the screen will change. The image below depicts increasing the slider to +$199.

If I want to put $199 more each month towards my monthly payment, which is a total monthly payment of $1849, I will save paying on my loan for 104 payments instead of 120 payments. I will also save $7,166 of interest. The grid summarizes the total changes.

The calculator list the weighted average of my student loan interest to be 5.80%. Based on this interest amount, a $199 increase in my monthly payment will save me 16 payments (120 months- 104 months). This is almost one and a half years of payments. I will be done paying my loans in 2028 instead of 2030. It also means based on my interest, I will save $7,166 in total. I will pay a total of $190,868 over 8 years and 8 months.

The more you move the slider, the more you will learn about your total savings. This will allow you to target a specific payoff date based on your monthly increased payment amount.

Step 4: Compare Pay Quickly to Pay Less

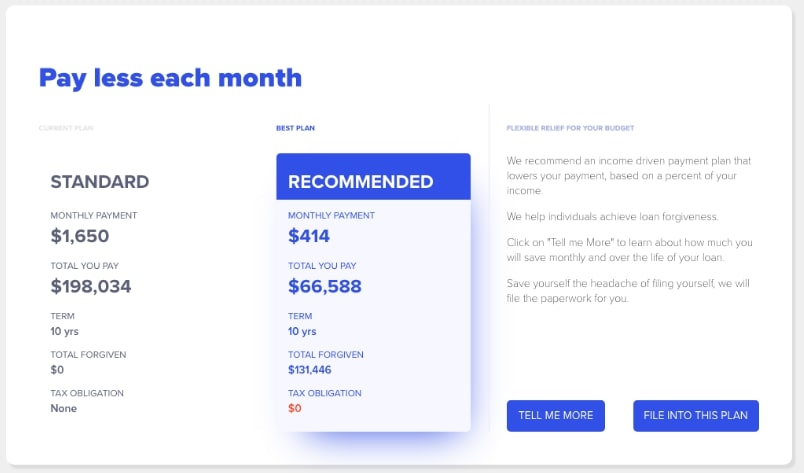

I can compare my interest savings and my payoff timeline from "pay quickly" in the monthly payment calculator. I can compare my total payment of $190,868 total and 104 months of payments to the data outputs on the "My Recommendation" Screen. This is what the "My Recommendation" screens read.

My recommendation is indicating that if I enroll in the recommended income-driven plan on the "Recommended" blue box, I would be paying $414 monthly and the total I'd pay is $66,588. I would receive the forgiveness total of $131,446 and have a $0 tax obligation.

This example is based on the person working for a qualified public service employer and filing their paperwork correctly.

What am I comparing - paying ~$190K over 8 years at a monthly rate of $1849 or file into the recommended income-driven plan and public service loan forgiveness program to pay $414 monthly, a total of $66,588 and get $131K forgiven. LoanSense can immediately help you file into the plan.

Total savings

- ~$1500 monthly. You can use the difference to buy a house or save for retirement

- The total of $131K in forgiveness is based on filing into the program properly each year. We can help with this.

The two tools allow people to perform the analysis --essentially somebody may say "I want to get out of debt in 5 years" but if this means you have to pay ~$2600 monthly versus paying $414 and use those funds for other wealth-building opportunities, is it worth getting out of debt sooner? NO.

These numbers only serve as an example to help you perform your own analysis and do not imply that you will experience the same exact level of student loan forgiveness. It is completely dependent upon the level of debt you are in, your annual earnings, the number of dependents you have, and a few other factors.

If you have any questions, contact us at loanhelp@myloansense.com.

Or get started now for help.

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.