When does your income-tax filing status affect your student loan payment?

The way you file your income taxes affects your student loan payments if you are in an income-driven repayment plan. If you are a standard plan or any other type of plan that is not based on your income, then filing jointly is most optimal. This tool is for one or both people in a legal marriage that is in an income-driven plan and want their student loans forgiven.

How the Marriage Tax Tools Helps

LoanSense Marriage Tax tool helps married couples weigh the aggregate benefit of filing jointly and compares it with filing separately. The LoanSense tool accounts for the marriage tax filing separate penalty as well. LoanSense tax tool does not account for other tax credit you may receive or lose as a result of filing separately. This is why it is vital you take our calculated numbers compiled for educational purposes to a tax professional.

Please note: LoanSense software is available for educational purposes only and does not imply that we are giving you tax advice or financial advice nor do we take responsibility for your ultimate decision on your tax or student loan filings.

Tool Breakdown

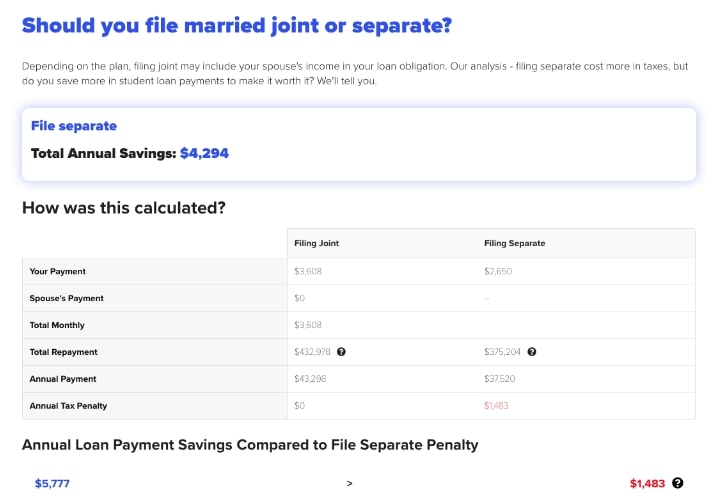

The tool gives the final recommendation at the top of the screen in blue.

However, the tool breaks down the analysis we performed to reach this tax filing conclusion. The middle column is the annual analysis from filing jointly and the right hand column is the analysis from filing separately.

Your Payment - The amount in each column represents the total loan amount you would have to pay monthly. You can see right away, if filing jointly or separately has a impact on your monthly payment. This accounts for the plan type we recommend. REPAYE will always count your student loan as a joint payment. There are other factors we help analyze.

Spouse's Payment - If your spouse has no student loans, it will read $0. If your spouse has student loans, this row will break down their annual student loan payment based on the tax filing status as well.

If you file jointly, then both of your incomes will be combined and the total each of you owes is based on the percentage of student loan debt you or your spouse has compared to the total. This equation is equal to your student loan debt divided by your student debt + your spouse's student debt (your debt/ both of your student debt). This ratio will determine your payment as compared to your spouse's payment with calculated based on your combined discretionary income.

If you file your income taxes separately, the tool will consider your individual income and individual debt, unless either of your are filed into the REPAYE plan. Our calculator assumed your spouse is NOT filed in the REPAYE plan, but if the assumption is wrong our analysis will not be accurate. The REPAYE plan considers you as joint filers regardless of how you actually file your income taxes. This analysis does not work, if you are enrolled in the REPAYE. If it's more advantageous to file separately, consider enrolling in the PAYE or IBR plan instead. Our software should already recommend the optimal repayment plan in "My Recommendation"

Total Repayment - This accounts for the total you and your spouse will pay over the lifetime of your loan, assuming a 3% salary increase, along with any tax bomb, if you are not a public servant. The full explanation of tax bomb is in the "My Recommendation" screen break down.

Annual Payment is the Total Repayment divided by the number of years you are expected to pay. This is the cost to you in a 12 month period.

Annual Tax Penalty is the penalty you incur for filing your taxes separately. This is zero if you file jointly and our calculator tells you the filing separately penalty based on the data you gave us.

Final Analysis - We compare what you'll pay annually in the two columns. We take the difference between the two numbers and if the amount is larger than the filing separate penalty listed in the last row, then we recommend you file separately. If the penalty is greater than the total savings, then we recommend you file jointly.

If you have any questions about your calculation or analysis, email us at loanhelp@myloansense.com.

If you are interested in accessing this tool, get started today.

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.