Getting married is extremely exciting!

There are many financial decisions to make but wait - it also affects your student loan payments?!?! As if you don't have enough to worry about, right?

LoanSense is here to make it easy. We directly tell you how to file your income taxes. You update your income information annually and we update the recommendation accordingly.

How does the LoanSense Marriage Tax Calculator work?

We help couples assess the impact on their overall financial picture. This means - what will happen to your student loan monthly payment, considering both you and your spouses' income, student loan balance, and employer type.

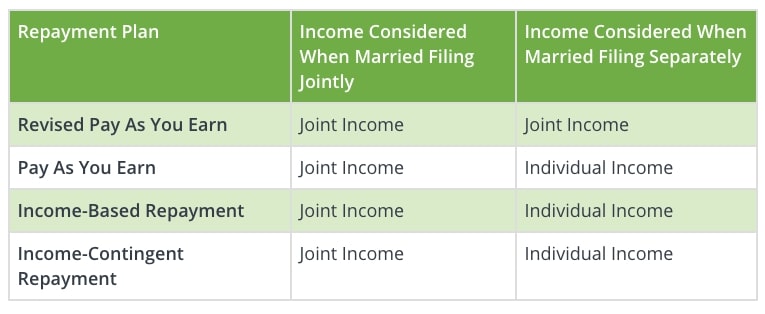

There is a generic rule with some exceptions:

- If you file jointly, your joint income will be considered in calculating your student loan payment.

- If you file separately, your individual income will be used to calculate your loan payment.

If you file your income taxes jointly with your spouse, you may save on income taxes, but your spouse's income will also get counted in your student loan payment. This is true for your spouse as well. It will depend on your student loan plan.

Exception: REPAYE will consider you and your spouse as if you filed jointly, even if you filed your income taxes separately.

This is why it's important to be on the right student loan plan, IBR or PAYE, if you want to file your taxes separately and not have your spouse's income count as part of your loan payment. You must understand if your annual loan savings is greater than the married filing separate tax penalty in order to understand the overall financial burden.

Here is a breakdown by plan types. Is the loan payment calculated based on your joint or individual income? Notice the exception of REPAYE.

We are not tax experts and filing separately has more complex considerations. However, having a clear understanding of how filing separately will affect your student loan payments and the filing separate tax penalty is a huge benefit to decision-making.

Generic Recommendations

- File separately if your spouse does not have student loans. Their income will not be counted into calculating your annual student loan payment. However, make sure the married filing separately tax penalties are worth the savings and make sure you are not enrolled in the REPAYE plan.

- If you both have student loans and earn relatively similar amounts, file jointly. This is a generic rule and of course, income parity is all relative. This is why weighing the tax filing options and loan payments in our calculator helps to determine the benefits of filing either jointly or separately.

Examples Case- Filing Separately Saves Couple $2500.

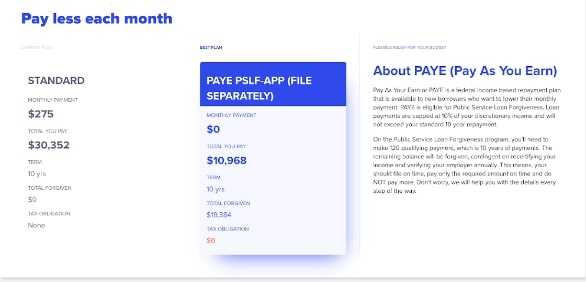

Below is a screenshot from our application of a user who is on the PAYE plan and her payment is $275 per month because they currently file their income taxes jointly. This means her spouse's income is counted to determine her payment.

If she were to file separately, her student loan payment would be zero. How? Because her individual earnings in the discretionary income formula indicates that she can't afford a payment above zero.

This $0 payment for 12 months saves her $3300 in student loan payments. The tax penalty is ~$500 so it's worth it to file their income taxes separately. The borrower is at the end of her loan forgiveness program and will get almost $20,000 forgiveness as well if she files her paperwork properly. LoanSense helped her make the critical tax filing decision immediately and helped her file her annual paperwork. She was ecstatic!

If you would like to learn more - the US Department of Education blog published an excellent example of all the tax filing options along with implications to the borrower's student loan payments.

Any inquiries can be made to loanhelp@myloansense.com

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.