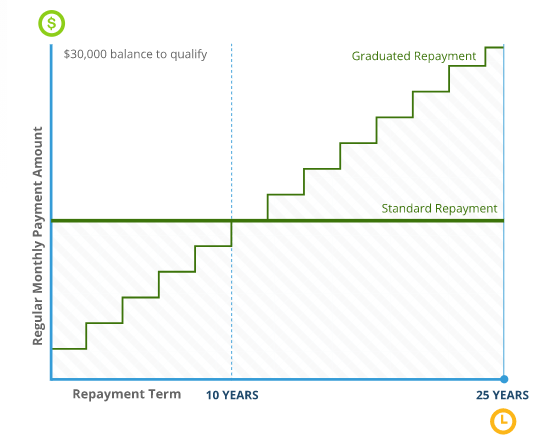

They start out lower but you pay more over time.

Extended graduated plans are plans in which the monthly payment increases every 2 years and extends over 10 years. Depicted to your left.

Graduated plans are the same monthly payment amount extended beyond 10 years.

Both plans have lower payments than a standard 10-year level plan, the plan everybody is automatically put on.

If your interest is over 5%, stretching out your loan will cost you a ton more over time. You are turning your student loan into a long term mortgage. Extended plans do NOT forgive any interest.

According to the US Department of Education, almost 2 million Americans are on extended plans.

If you are struggling to afford your payments, we recommend an income-driven plan, PAYE, REPAYE, IBR. The right repayment plan for you would be displayed on your recommendations tab with LoanSense.

You can receive interest subsidy and interest forgiveness from the government over time if you file paperwork annually and it’s worth the thousands of extra dollars you’ll pay on an extended plan.