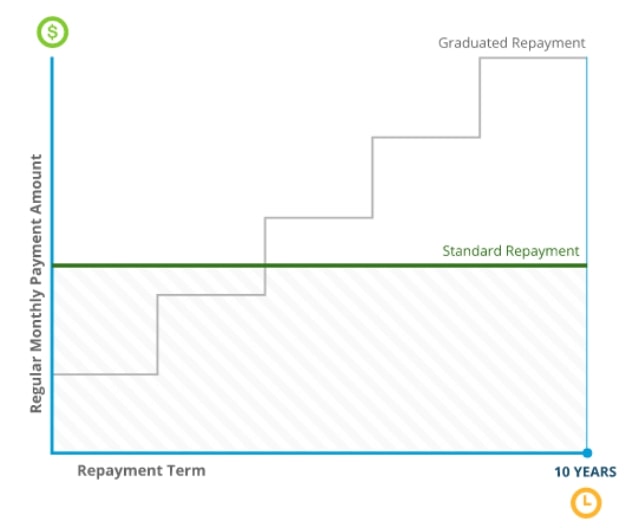

Graduated plans are like balloon mortgages, which contributed to the financial crisis. Your payment starts smaller but goes up over time in increments, usually 2-year increments.

Some borrowers we meet say, “I’ll make more money later and it’ll be fine”. Let’s say you graduate at 22, your payment goes up at 24, then 26, 28 and 30. People get married, start families and their payment goes up. This means financial responsibility also increases even if your income increases.

If you are struggling to make payments, consider income-driven plans where you actually receive interest forgiveness from the government.

The data tells us that it's better for borrowers to consider income-driven plans because payments will always be adjusted to your income and will not put the borrower in the precarious position of ballooning student loan payments at a time when they can't afford the payment.

To understand how payments are adjusted to income - check out the article on discretionary income.

Any inquiries can be made to loanhelp@myloansense.com

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.