LoanSense has recently announced critical new capabilities that help lenders fight back in this tough environment of high-interest rates, inflation, and economic uncertainty. The company works directly with lenders and their clients to enroll them into the best student loan repayment plan to increase their chances of homeownership.

LoanSense provides lenders a competitive advantage to reach borrowers who may not have previously been able to purchase a home as a result of high debt-to-income because of student loans.

“We’ve analyzed data from several top-ten lenders and found they declined over $300 million in loan volume over the last year from student loan borrowers that could have been lowered,” said Catalina Kaiyoorawongs, CEO of LoanSense. “In this market, every loan counts. Our data service systematically helps lenders originate more loans they would have otherwise declined.”

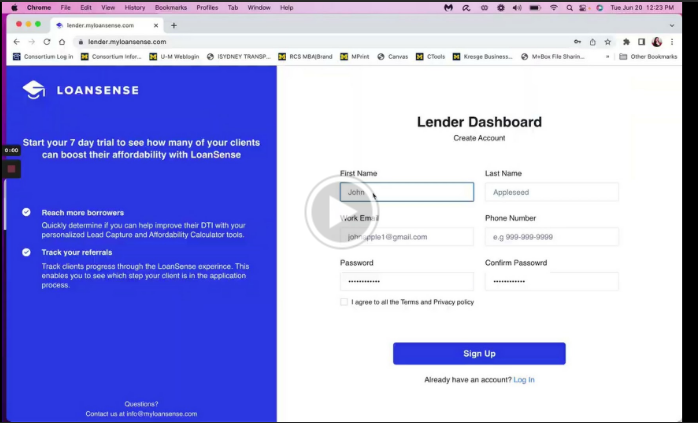

Sign up for a lender dashboard account

LoanSense’s new lender dashboard helps lenders:

-

Quickly estimate the potential student loan payment reduction and the resulting increase in home buying power.

-

Generate more leads through a customized lead capture tool. This allows lenders to reach 17 million renters with student debt in the first-time purchase demographic.

-

Track their pipeline of clients with student loans to see where they are in the process to improve their debt-to-income ratio.

-

Get access to LoanSense’s loan advisors who are experts in the world of student loans.

LoanSense’s new lender dashboard helps lenders increase their origination volume with minimal extra lift on their end.

LoanSense is offering lenders a free analysis of exactly what their loan uplift would look like. Sign up to have LoanSense analyze your data.

See how to sign up for the lender dashboard.

Any inquiries can be made to loanhelp@myloansense.com

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.