LoanSense can assist you in streamline filing to get you access to thousands of dollars of loan forgiveness.

We assist in filing into the income-drive repayment plan (IDR) and employer verification forms for the Public Service Loan Forgiveness program with 100% accuracy to date. We can also assist with the student loan consolidation paperwork.

From the moment you log on to hitting submit takes about 10-15 minutes maximum. This section is a breakdown of the filing steps. We streamline the process because we do not ask repetitive questions. We will automatically file LoanSense recommendations.

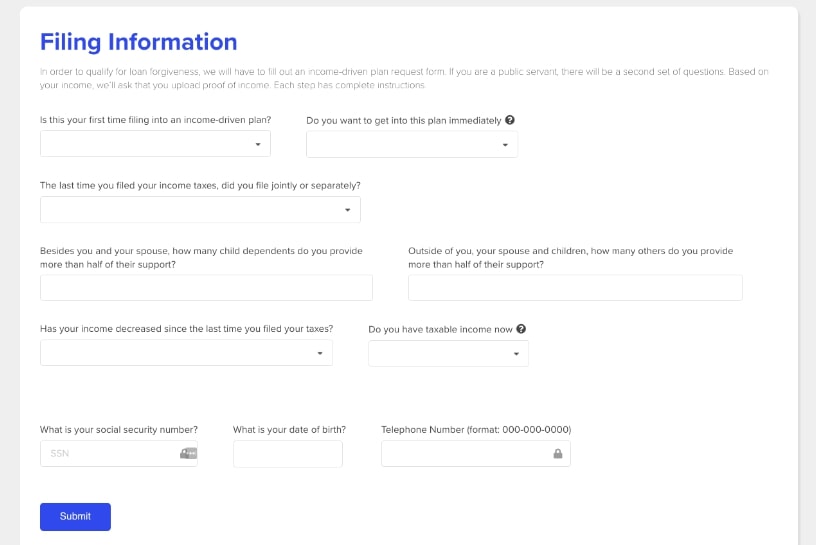

Income-Driven Repayment Plan Filing

The top section of the filing process is designated for the income-driven repayment plan filing.

These are the questions we ask you:

- Are you filing for the first time or is it a re-file?

This helps us understand the filing status to report on the form. There are generally 4 reasons to file: to reduce your payment, to re-file annually, on-time every year, to change your loan plan (ie- move from REPAYE to PAYE), or to enroll into a plan for the very first time.

- File Now or file later?

Do you want to get into this plan immediately and essentially have LoanSense file as soon as possible? The only reason to answer no to this question is if you are in your grace period and would like to come to the end of your grace period. However, if you are in the position to and/or we are in the $0 payment period set by congress due to COVID-19, putting yourself into repayment sooner is better. The reason is that $0 payments can actually count towards loan forgiveness.

3. Income-tax filing status

This question is about your prior income-tax filing. Did you file single, married jointly or separately? If you realize that you would like to file your income-taxes separately from your spouse because our marriage tax calculator indicates it's better financially, we recommend you consult an accountant as LoanSense is not an accountant or tax professional.

However, if you decided that its best to file separately and you did not file separately the prior year, you have two options: 1) file your IDR paperwork after you file separately. Only do this if this will not cause you to be late. 2) File jointly now and then re-file your paperwork after you complete your next income-tax returns.

4. Dependents

We ask questions about your dependents- how many people do you provide more than 50% of their support? This includes children as well as adult dependents. You can list them in each question. The more dependents you have, the lower your discretionary income is. This lowers your monthly payments, so fill this section out as accurately as possible, so we can get your the best repayment amount.

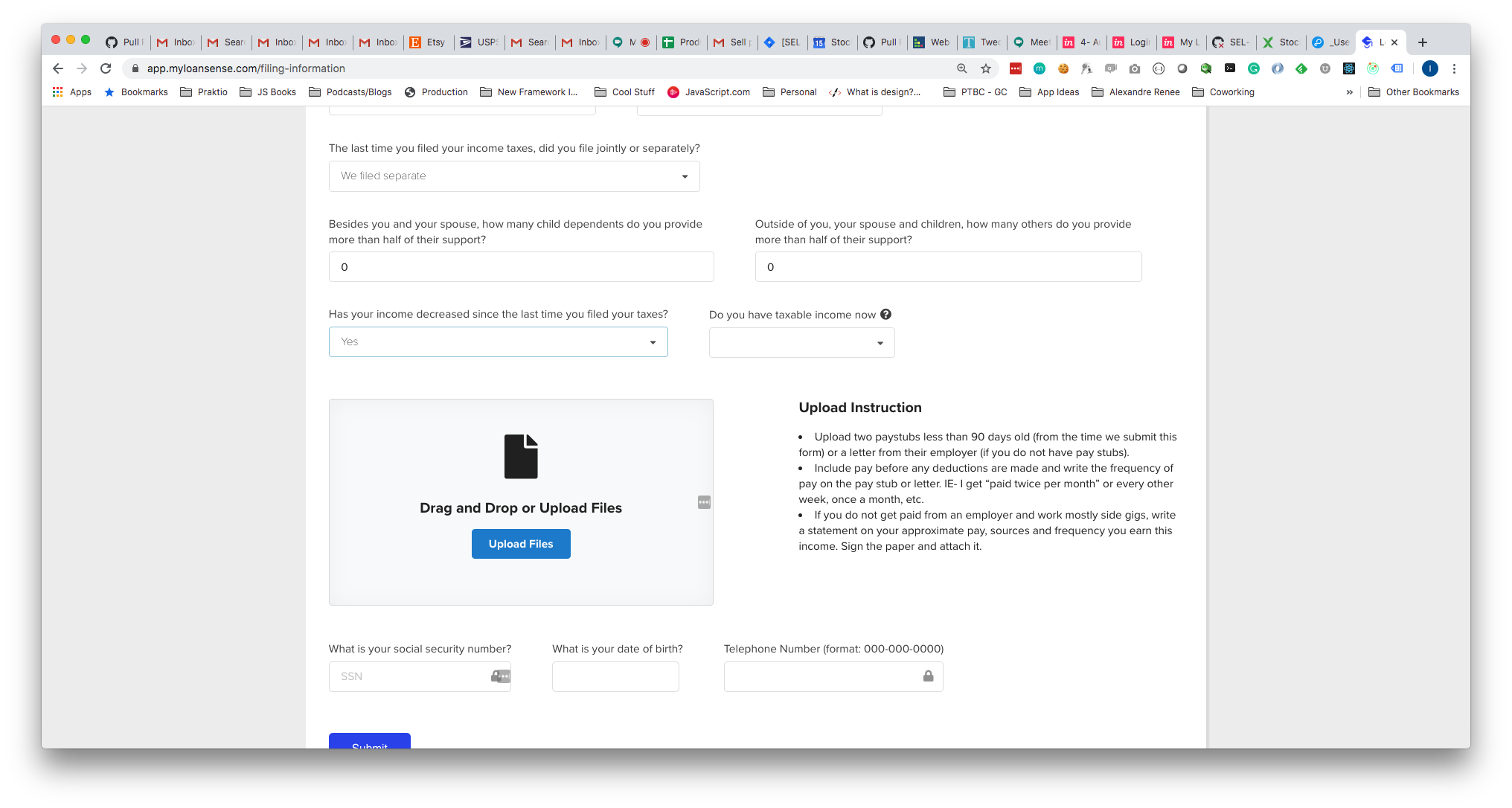

5. Income changes - Submit the form of income that shows the least amount of earnings.

LoanSense asks you if your income has changed because we want to help you document the best form of income to submit. If your income has dropped we will ask that you submit pay stubs that are less than 90 days old. We ask that you indicate the frequency of pay on the pay stubs with a PDF software. An example includes "pay twice a month - 24 pay periods" or "paid every other week - 26 total pay periods".

If your income does not drop, we will ask that you submit your las tax return. We also provide instructions on where to retrieve your tax return. Submit the form of income that shows the least amount of earnings.

Either way - the upload instructions are next to the upload box.

Employer verification Form - PSLF Process

We recommend you file this paperwork at least once a year!

6. Public Service Loan Forgiveness Program - Employer information

If you are also filing into the Public Service Loan Forgiveness program, we will ask for your employer's information. Information we ask for:

- Employers' tax identification number. This can be located on your tax filing paperwork (W-2, W-4, 1099)

- Employer's address - Please use their official tax filing address, which may not be the physical location you work. Find out this information.

- Your employment start date and the number of hours you work weekly on average. It's vital that you enter the exact start date. Please do not GUESS the your start date.

Once you submit the form, we will follow up with a brief email template to send to your employer in email cc-ing info@myloansense.com. We will streamline the employer signature for you. We ask these 2 things of your employer - sign the document within 3 business days of receipt and to please sign using a mouse signature. NO TYPED SIGNATURES ARE ALLOWED.

6. Personal information

The last part of the form includes all your personal information. If you are married, we will ask for your husband's information as well. We ask for your social security -it's encrypted and we use bank level security, so the information is safe. However, if you feel uncomfortable entering your social security number, you can also enter it yourself and submit the paperwork we send you. Otherwise, we will send you an electronic signature request.

After you file - Next Steps

You will receive the paperwork back within 3 business days ready for a signature or there will be follow up questions. Once you receive the electronic signature documents, we ask that you: 1) sign the paperwork within 3 business days; 2) Only use a mouse to sign the documents.

Once the paperwork is submitted on your behalf with your income-details, LoanSense will send you electronic proof of this submission. Please keep these for your permanent records. You will need this information to receive ultimate loan forgiveness.

Check up on your filing status with your loan servicer within 2-3 weeks.

If you have any questions about your filing, please email loanhelp@myloansense.com

Or sign up to get started today!

Get started now >>

We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful.