Congress passed a $2 trillion stimulus package. This has a significant benefit to those with federal student loan debt-more than skipping payments. CARES Act gives more benefits than $0 payments and 0% interest for 6 months. You can use this time to extend lower payments and get loan forgiveness.

Here’s why:

The bill includes a provision for employer contribution towards their student loan payments. Employers could provide a $5,250 annual student loan repayment benefit to employees on a tax- free basis. Such payment would also be excluded from the employee’s income. This measure will have to be renewed in 2021 in order to be permanent.

Summary of Student Loan Provisions

- Suspension of all payments for six months through September 30, 2020. The loan servicers have been instructed to put this into place automatically without a borrower requesting to suspend payments.

- Student loan interest is at 0% until September 30, 2020, on most federal loans. This started on March 13, 2020, when President Trump announced the interest freeze. This means any payments made now will go to the interest that accumulated before March 13th, then directly to the loan principal.

- The six months of suspended payments count towards loan forgiveness programs, including Public Service Loan Forgiveness (PSLF) and all Income-Driven plans, including PAYE, REPAYE, IBR, etc

- Borrowers in default will have their six months of suspended payments count towards the nine months needed for loan rehabilitation.

- Collections, wage garnishment, or seizure of tax refunds will be frozen.

Unfortunately, the forbearance and interest freeze does not benefit those with private loans, FFEL loans held by private institutions, or the Department of Health student loans.

The reality is borrowers with federal loans already have protections in place in which they can get their student loan payments down to zero dollars a month. However, requiring a borrower to call their servicer and get timely changes with massive layoffs will be challenging.

The best news about not requiring action from borrowers is also allowing the $0 payments for 6 months to count towards loan forgiveness. This isn’t just a benefit for public servants, but these 6 months of $0 payments also count towards the 20 year PAYE or other income-driven plans for private-sector employees.

6 million dollars left behind There are 6 million borrowers with non-direct loans that are left behind in this bill. This includes many healthcare professionals, unfortunately. They may qualify to consolidate their loans to receive the $0 payment, however, one thing to know about loan consolidation is it starts the clock over, if you want to qualify for forgiveness. That means 120 or 240 payments start from the time you consolidate. If you are looking to get loan forgiveness, consolidation may still be the answer though or it can be more costly. It all depends on your personal circumstance.

LoanSense can help employees or individuals decide if consolidation is right for them.

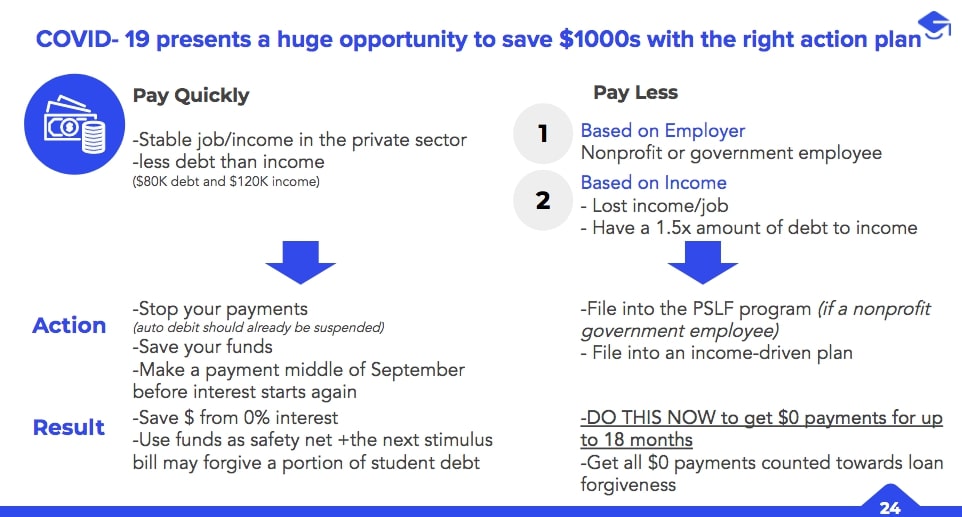

Recommendation - COVID-19 can save you $1000s if you take the right actions now.

- Stop making payments. If you make payments past March 13, 2020, ask for your funds back.

- If you are a public servant, make sure you are filing your paperwork properly, so you qualify to receive as many of these $0 to count towards loan forgiveness. Two forms are required.

- Consider the chart below on your recommendations based on your loan payoff approach. If you do not have an approach, consider attending our webinar that will provide a full explanation of what actions you should take. Sign up for our webinar here.

FREE Webinar!! Sign up here>>